Announcement: Specialized AI fund CuriosityVC becomes a strategic investor at Onesurance

Announcement: Specialized AI fund CuriosityVC becomes a strategic investor at Onesurance

give your advisors

a headstart

With proactive customer management using AI, you make optimal use of your advisors' limited time while ensuring a better customer experience. We demonstrate that this translates into measurable results: higher commission revenue, lower cancellation rates, and increased profits.

start prioritizing

proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing

proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing

proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing

proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

one ai engine

30+ predictions

We provide forecasts specifically trained on your data and the unique dynamics of your portfolio. Our advanced AI modules use basic policy data to make precise predictions and calculate a business case tailored to you, all without the need for a data team.

Our most popular predictions

Churn

Forecasts at an individual customer level that predict when customers will churn.

Next best policy

We predict which policies have the highest chance of being secured, and when

Costs

Combined data provides a clearer view of operational costs per customer and segment

Customer Lifetime Value

An accurate calculation of the total potential customer lifetime value throughout their entire lifecycle

Feeders & Bleeders

Outliers that need more or less attention for the right cost-benefit balance

Efficiency

Identify which activities within your organization are taking up unnecessary time and money.

one ai engine

30+ predictions

We provide forecasts specifically trained on your data and the unique dynamics of your portfolio. Our advanced AI modules use basic policy data to make precise predictions and calculate a business case tailored to you, all without the need for a data team.

Our most popular predictions

Churn

Forecasts at an individual customer level that predict when customers will churn.

Next best policy

We predict which policies have the highest chance of being secured, and when

Costs

Combined data provides a clearer view of operational costs per customer and segment

Customer Lifetime Value

An accurate calculation of the total potential customer lifetime value throughout their entire lifecycle

Feeders & Bleeders

Outliers that need more or less attention for the right cost-benefit balance

Efficiency

Identify which activities within your organization are taking up unnecessary time and money.

one ai engine

30+ predictions

We provide forecasts specifically trained on your data and the unique dynamics of your portfolio. Our advanced AI modules use basic policy data to make precise predictions and calculate a business case tailored to you, all without the need for a data team.

Our most popular predictions

Churn

Forecasts at an individual customer level that predict when customers will churn.

Next best policy

We predict which policies have the highest chance of being secured, and when

Costs

Combined data provides a clearer view of operational costs per customer and segment

Customer Lifetime Value

An accurate calculation of the total potential customer lifetime value throughout their entire lifecycle

Feeders & Bleeders

Outliers that need more or less attention for the right cost-benefit balance

Efficiency

Identify which activities within your organization are taking up unnecessary time and money.

one ai engine

30+ predictions

We provide forecasts specifically trained on your data and the unique dynamics of your portfolio. Our advanced AI modules use basic policy data to make precise predictions and calculate a business case tailored to you, all without the need for a data team.

Our most popular predictions

Churn

Forecasts at an individual customer level that predict when customers will churn.

Next best policy

We predict which policies have the highest chance of being secured, and when

Costs

Combined data provides a clearer view of operational costs per customer and segment

Customer Lifetime Value

An accurate calculation of the total potential customer lifetime value throughout their entire lifecycle

Feeders & Bleeders

Outliers that need more or less attention for the right cost-benefit balance

Efficiency

Identify which activities within your organization are taking up unnecessary time and money.

safe and easy to integrate

AI prediction modules specifically built for the insurance industry mean quick measurable results without risk.

Powerful predictions

Discover the powerful predictions of our AI modules, specifically built for the insurance industry.

Safe and GDPR compliant

We understand how important data privacy and security are. Our solutions are ahead of the curve in data security and ethics.

Integrates with your CRM

Thanks to our standard integrations, you'll have your own solution up and running within a few weeks, avoiding long implementation times.

safe and easy to integrate

AI prediction modules specifically built for the insurance industry mean quick measurable results without risk.

Powerful predictions

Discover the powerful predictions of our AI modules, specifically built for the insurance industry.

Safe and GDPR compliant

We understand how important data privacy and security are. Our solutions are ahead of the curve in data security and ethics.

Integrates with your CRM

Thanks to our standard integrations, you'll have your own solution up and running within a few weeks, avoiding long implementation times.

safe and easy to integrate

AI prediction modules specifically built for the insurance industry mean quick measurable results without risk.

Powerful predictions

Discover the powerful predictions of our AI modules, specifically built for the insurance industry.

Safe and GDPR compliant

We understand how important data privacy and security are. Our solutions are ahead of the curve in data security and ethics.

Integrates with your CRM

Thanks to our standard integrations, you'll have your own solution up and running within a few weeks, avoiding long implementation times.

safe and easy to integrate

AI prediction modules specifically built for the insurance industry mean quick measurable results without risk.

Powerful predictions

Discover the powerful predictions of our AI modules, specifically built for the insurance industry.

Safe and GDPR compliant

We understand how important data privacy and security are. Our solutions are ahead of the curve in data security and ethics.

Integrates with your CRM

Thanks to our standard integrations, you'll have your own solution up and running within a few weeks, avoiding long implementation times.

our partners

The integration can be done within the own backoffice system, CRM, or with a Onesurance-hosted portal

define your own priorities

We understand your dynamics like no one else and are eager to assist you with our scalable, ready-to-implement AI modules. Our solutions can be deployed modularly to tackle the specific challenges you face. We’d love to analyze and find out where the best business case is within your organization.

Sales

Significantly and measurably boost policy density and commissions in no time.

Care

Fulfill your duty of care by offering the right policies to everyone in your client base.

Churn

Boost retention by proactively reaching out to customers with high commissions and a high churn risk.

EBITDA

Focus on the most profitable customers and use time of advisors more effectively.

define your own priorities

We understand your dynamics like no one else and are eager to assist you with our scalable, ready-to-implement AI modules. Our solutions can be deployed modularly to tackle the specific challenges you face. We’d love to analyze and find out where the best business case is within your organization.

Sales

Significantly and measurably boost policy density and commissions in no time.

Care

Fulfill your duty of care by offering the right policies to everyone in your client base.

Churn

Boost retention by proactively reaching out to customers with high commissions and a high churn risk.

EBITDA

Focus on the most profitable customers and use time of advisors more effectively.

define your own priorities

We understand your dynamics like no one else and are eager to assist you with our scalable, ready-to-implement AI modules. Our solutions can be deployed modularly to tackle the specific challenges you face. We’d love to analyze and find out where the best business case is within your organization.

Sales

Significantly and measurably boost policy density and commissions in no time.

Care

Fulfill your duty of care by offering the right policies to everyone in your client base.

Churn

Boost retention by proactively reaching out to customers with high commissions and a high churn risk.

EBITDA

Focus on the most profitable customers and use time of advisors more effectively.

define your own priorities

We understand your dynamics like no one else and are eager to assist you with our scalable, ready-to-implement AI modules. Our solutions can be deployed modularly to tackle the specific challenges you face. We’d love to analyze and find out where the best business case is within your organization.

Sales

Significantly and measurably boost policy density and commissions in no time.

Care

Fulfill your duty of care by offering the right policies to everyone in your client base.

Churn

Boost retention by proactively reaching out to customers with high commissions and a high churn risk.

EBITDA

Focus on the most profitable customers and use time of advisors more effectively.

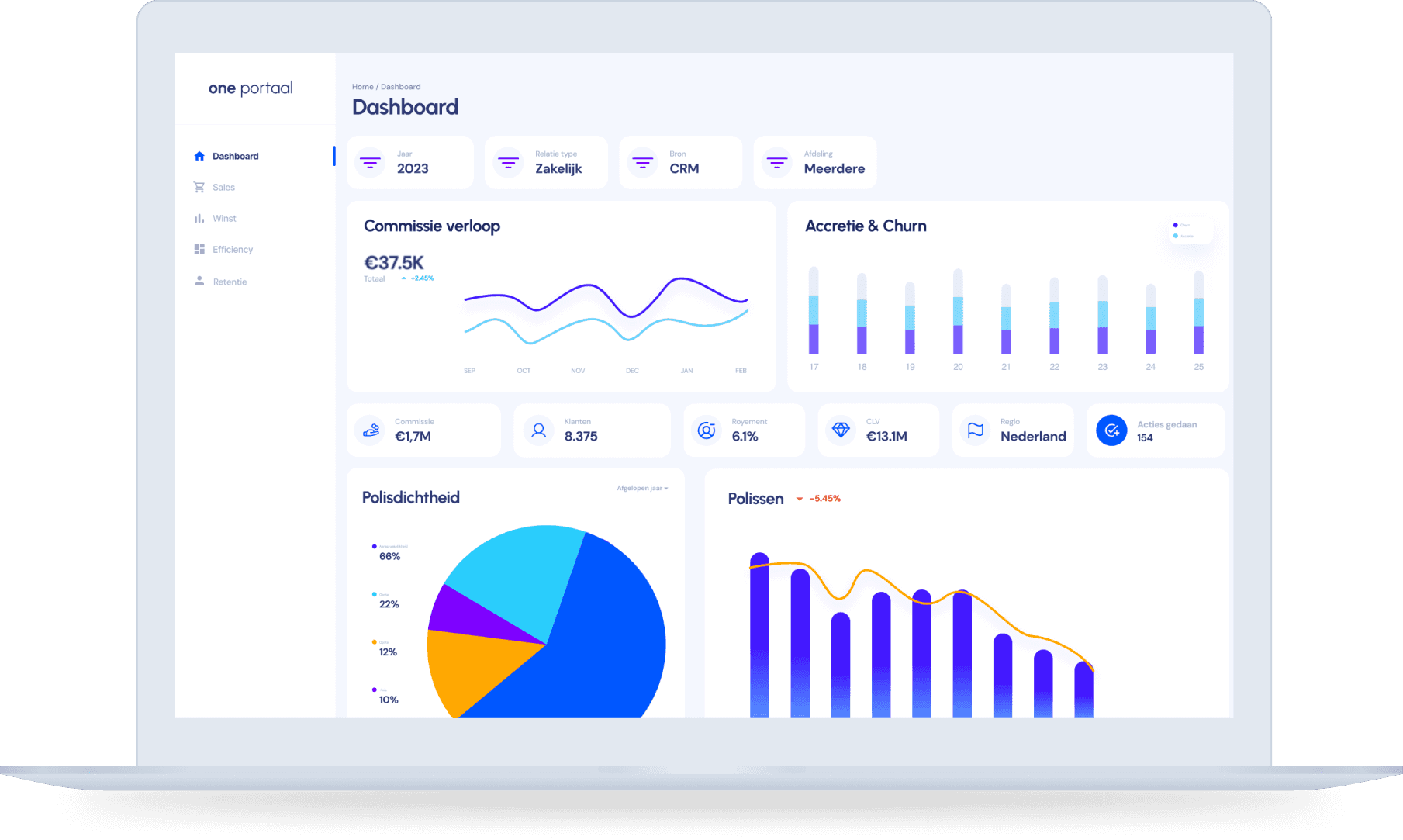

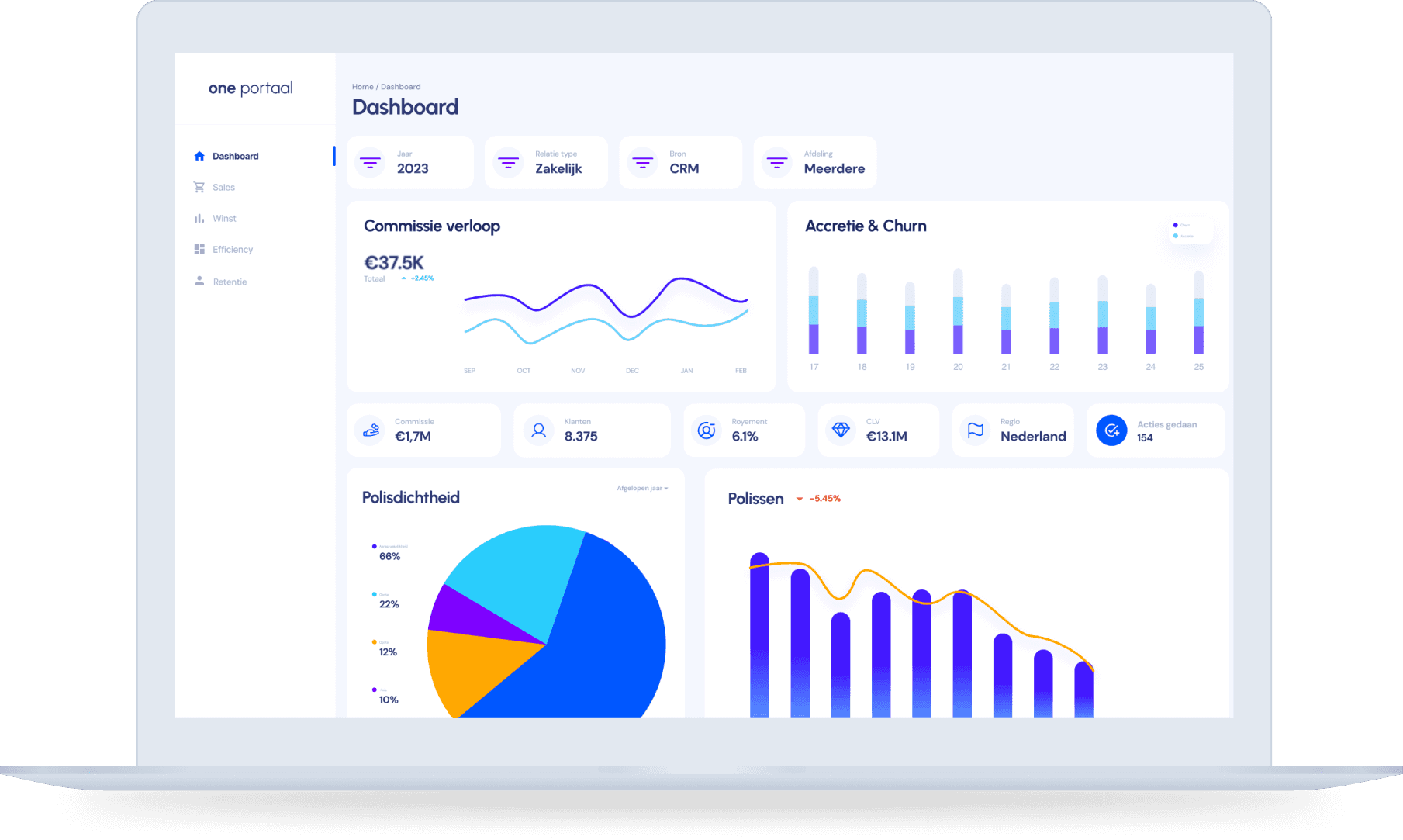

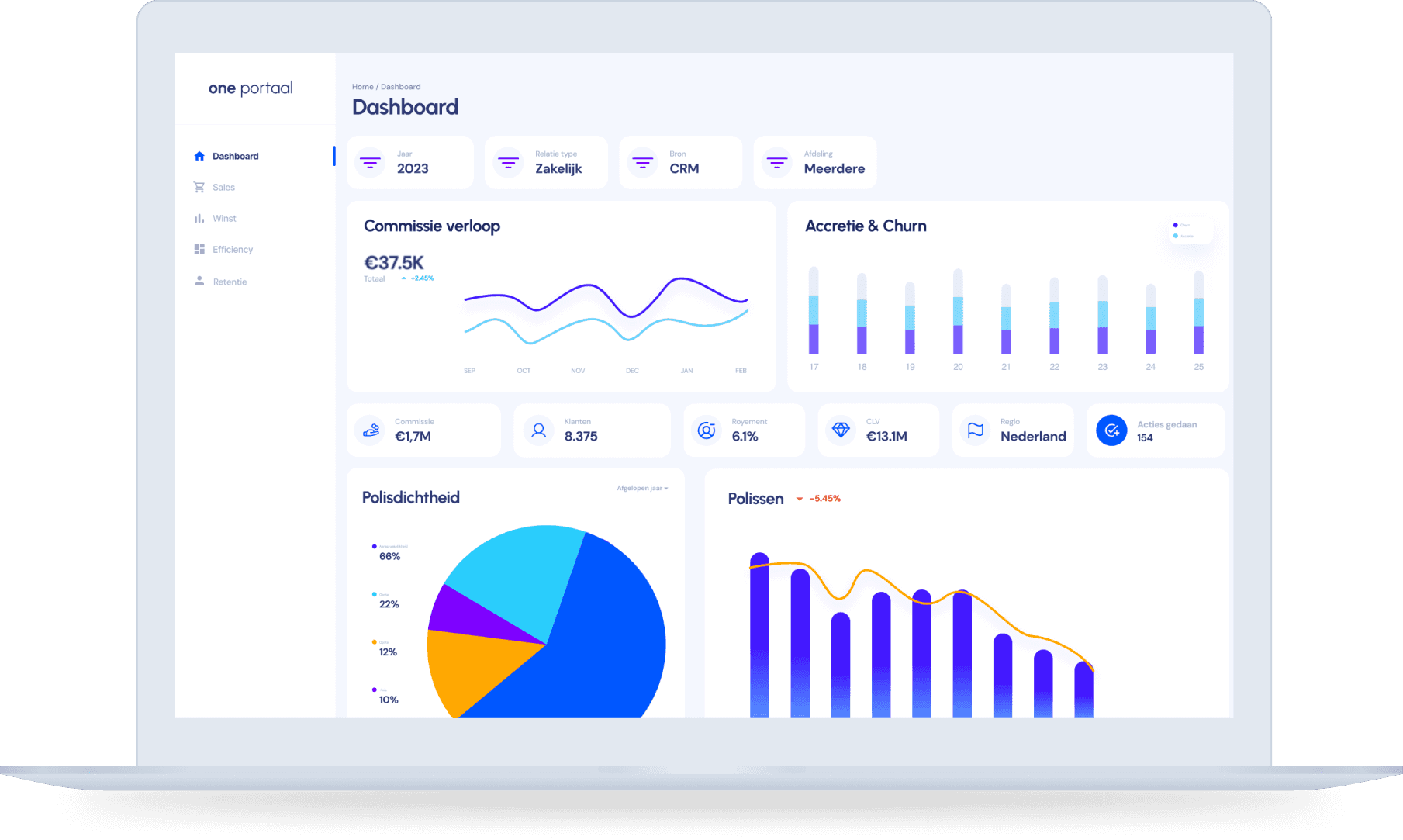

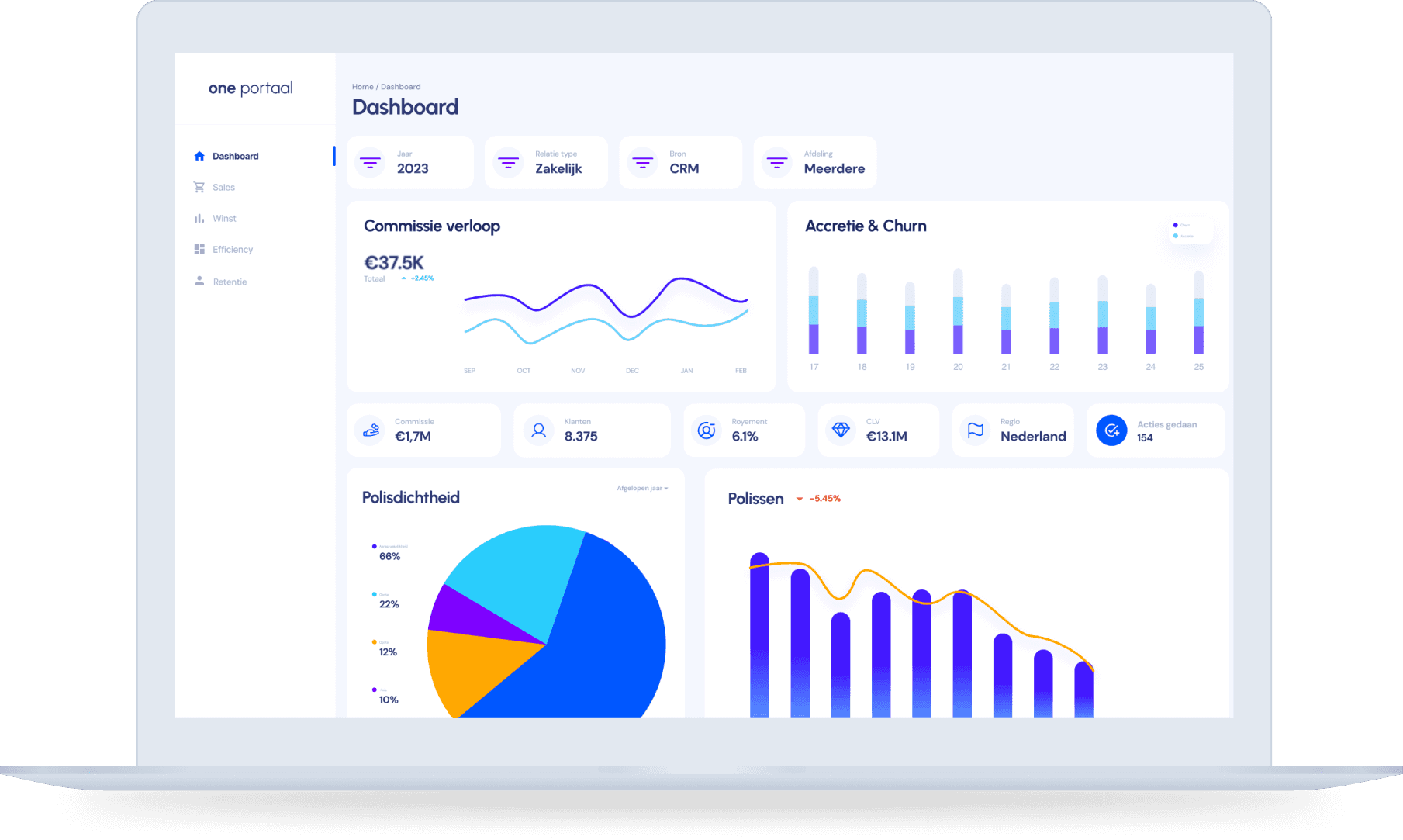

advanced technology

within reach for your advisors

We combine a clear understanding of day-to-day operations with next-gen AI predictions that support consultants and managers in their daily work.

advanced technology

within reach for your advisors

We combine a clear understanding of day-to-day operations with next-gen AI predictions that support consultants and managers in their daily work.

advanced technology

within reach for your advisors

We combine a clear understanding of day-to-day operations with next-gen AI predictions that support consultants and managers in their daily work.

advanced technology

within reach for your advisors

We combine a clear understanding of day-to-day operations with next-gen AI predictions that support consultants and managers in their daily work.

do you want to start now?

Schedule an appointment with our advisors right away and discover which module could be the perfect fit for your organization.

do you want to start now?

Schedule an appointment with our advisors right away and discover which module could be the perfect fit for your organization.

do you want to start now?

Schedule an appointment with our advisors right away and discover which module could be the perfect fit for your organization.