solutions for brokers

and intermediaries

By leveraging AI for proactive customer management, you can maximize your advisors' limited time while enhancing the customer experience. Our approach delivers measurable outcomes, including increased commission revenue, reduced cancellation rates, and higher profits.

what goals

does your organization have?

Our modules are designed to address the unique challenges of the insurance market. Depending on your strategy, you can choose from various product modules that can be used individually or in combination to elevate your business.

Onze modules zijn zo gebouwd dat ze binnen enkele weken op uw data aangesloten kunnen worden, en uw mensen er mee aan de slag kunnen.

Operationeel

binnen 2 weken

Onze modules zijn zo gebouwd dat ze binnen enkele weken op uw data aangesloten kunnen worden, en uw mensen er mee aan de slag kunnen.

Operationeel

binnen 2 weken

Onze modules zijn zo gebouwd dat ze binnen enkele weken op uw data aangesloten kunnen worden, en uw mensen er mee aan de slag kunnen.

Operationeel

binnen 2 weken

start prioritizing proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

start prioritizing proactive customer management

Focus on the right customer

Base your predictions on proven data to choose the clients who need attention right now. Stop worrying about selecting the best client for a touchpoint, and use the time for personalized attention.

At the right moment

Every customer is unique, and the opportunities to reach them are limited. Our algorithms predict which customers might cancel their policies in the coming months, or when there's a high likelihood of life-changing events requiring different policy needs.

With the right attention

Some customers benefit from an in-person visit, while others prefer managing everything online. Our solutions predict which approach will work best and partially automate the process, allowing your advisors to focus on providing personalized attention.

And the right product

Personalization leads to higher conversion rates and offers opportunities to automate part of the contact moments. This takes the load off the advisor, enhances the customer experience, and reduces operational costs.

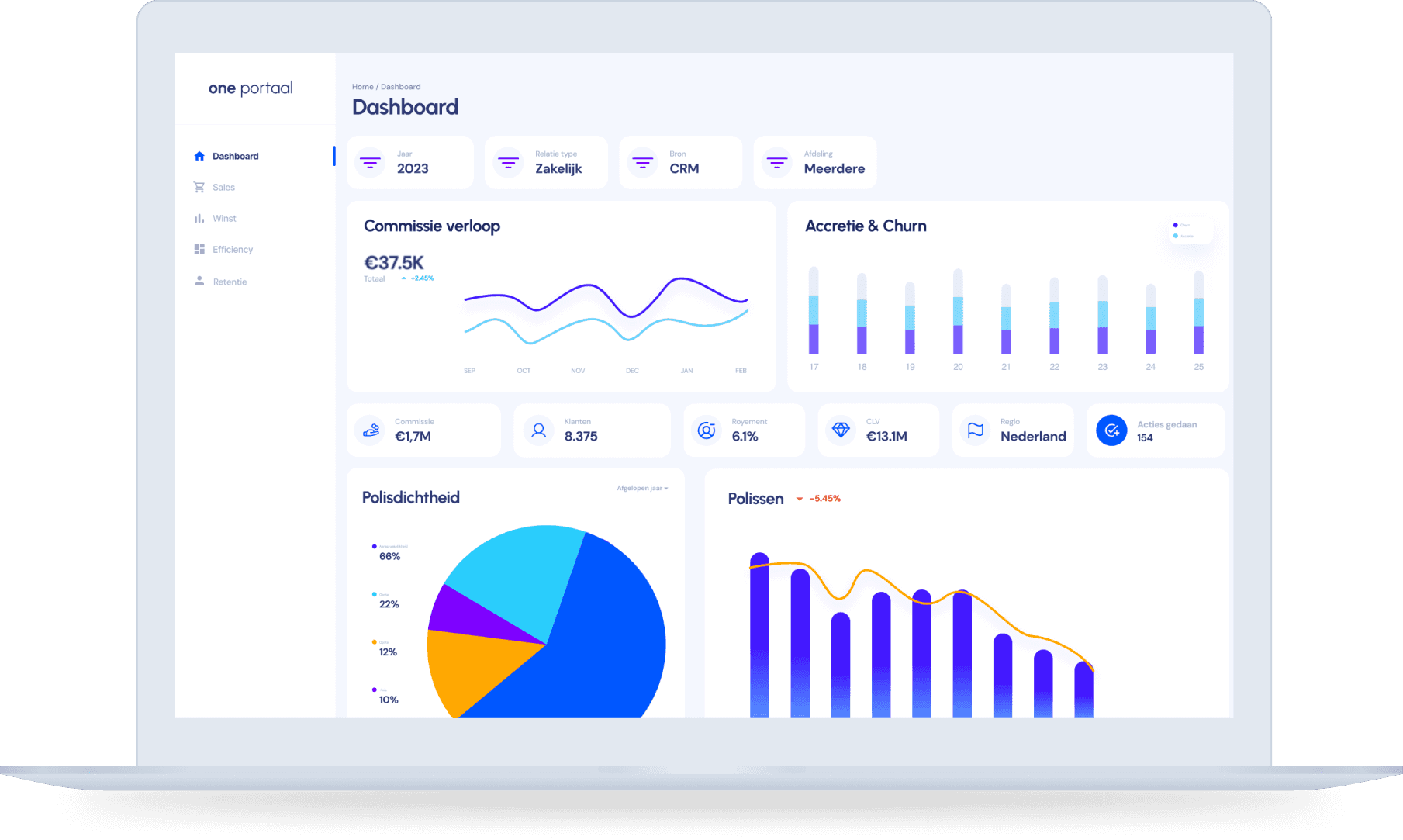

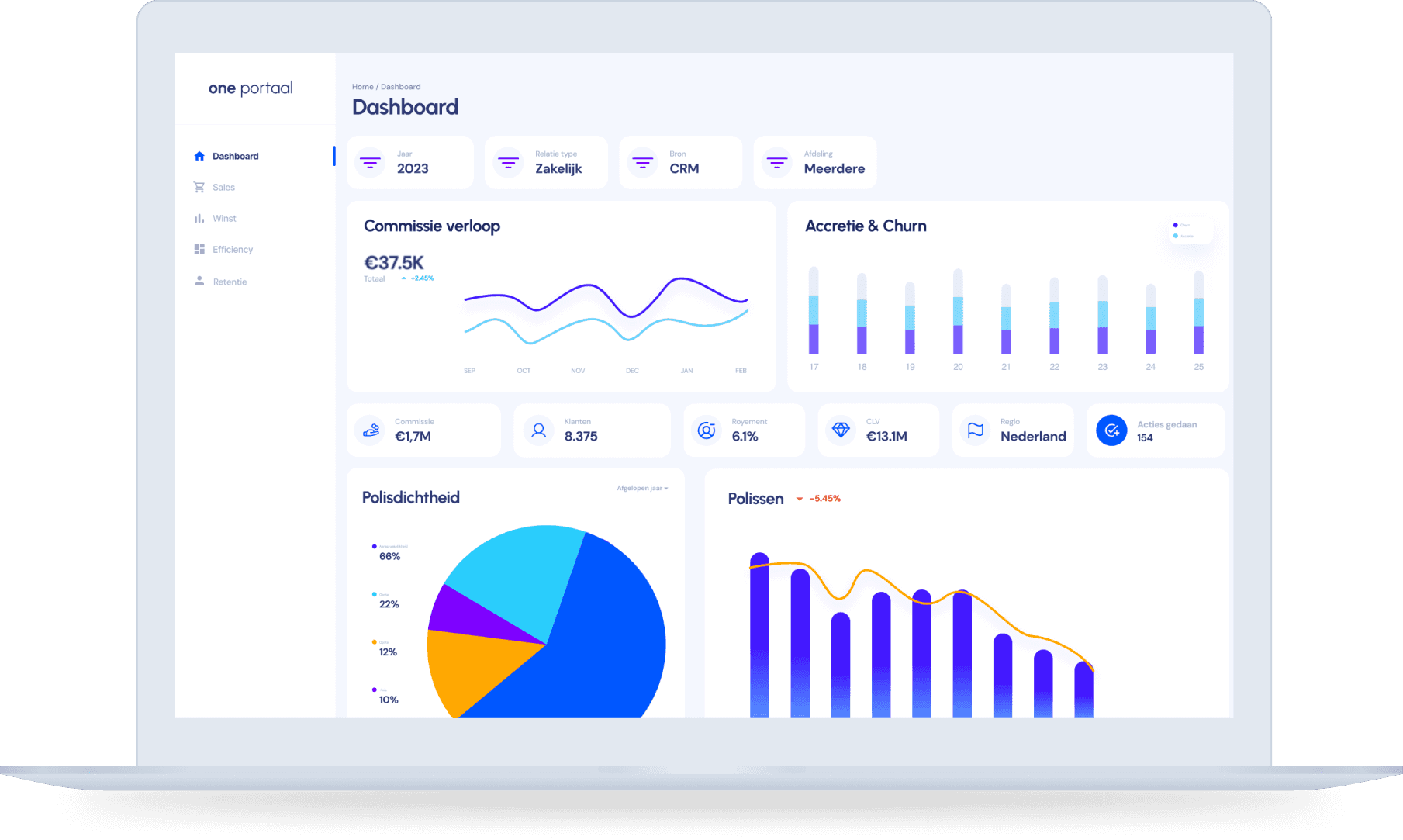

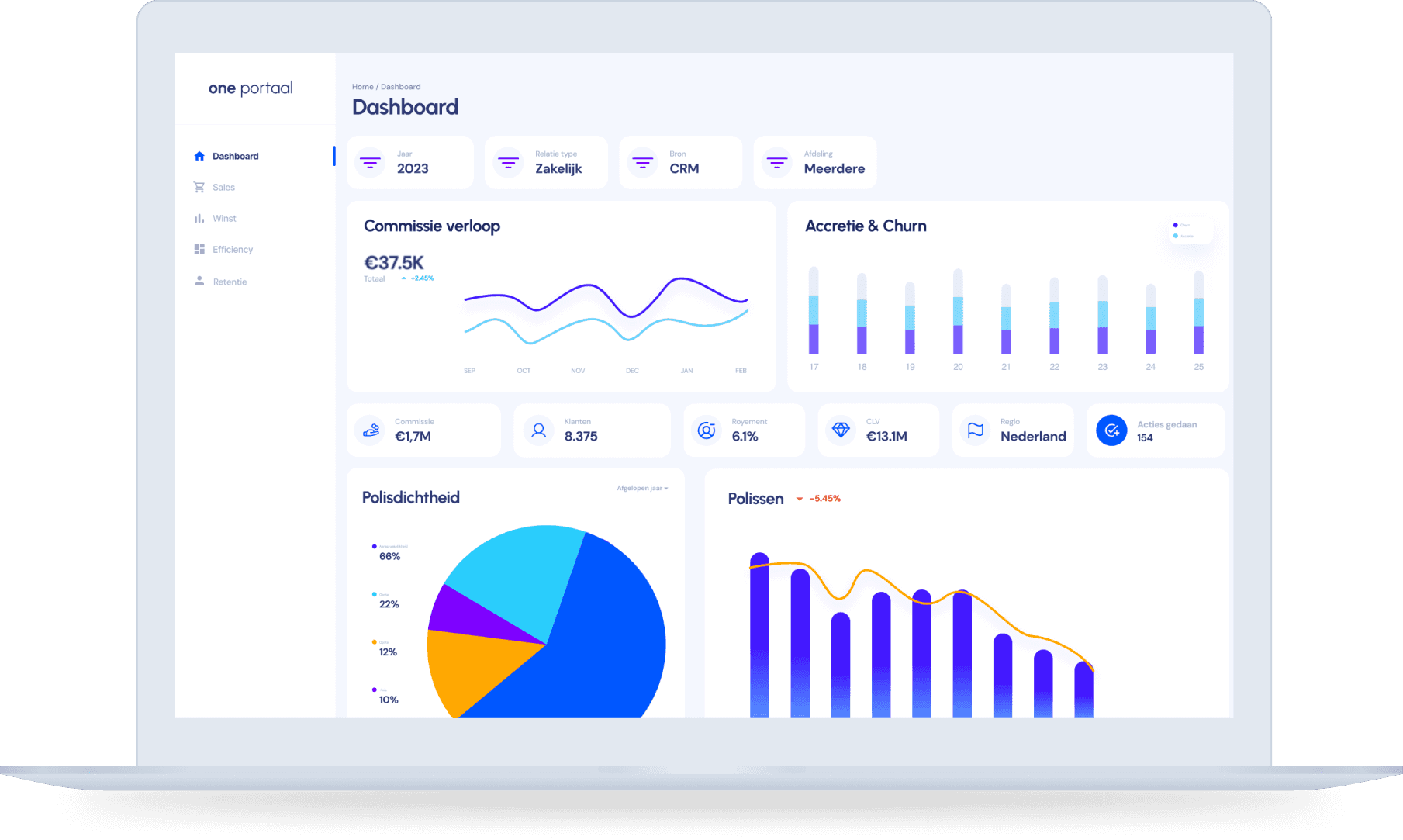

an intuitive interface

for the advisor

Solutions

Solutions

©2025 Onesurance B.V.

Solutions

©2025 Onesurance B.V.